Partners Value Investments LP (PVF.UN): Cheap Exposure to Brookfield Asset Management

The single largest position in my holding company's portfolio is Brookfield Asset Management (BAM.A) (BAM), an alternative asset manager that focuses on real estate, infrastructure, renewable energy, and private equity.

Brookfield is unique in so many ways. It has a track record that is among the best in the business. Brookfield also has size, scale, and a global operating presence that few of its peers can match. Lastly, the company has spun-off publicly listed vehicles that allow everyday investors like you and I to capture the performance characteristics of its various asset classes. The securities are listed below:

- Brookfield Property Partners (BPY)

- Brookfield Infrastructure Partners (BIP)

- Brookfield Renewable Partners (BEP)

- Brookfield Business Partners (BBU)

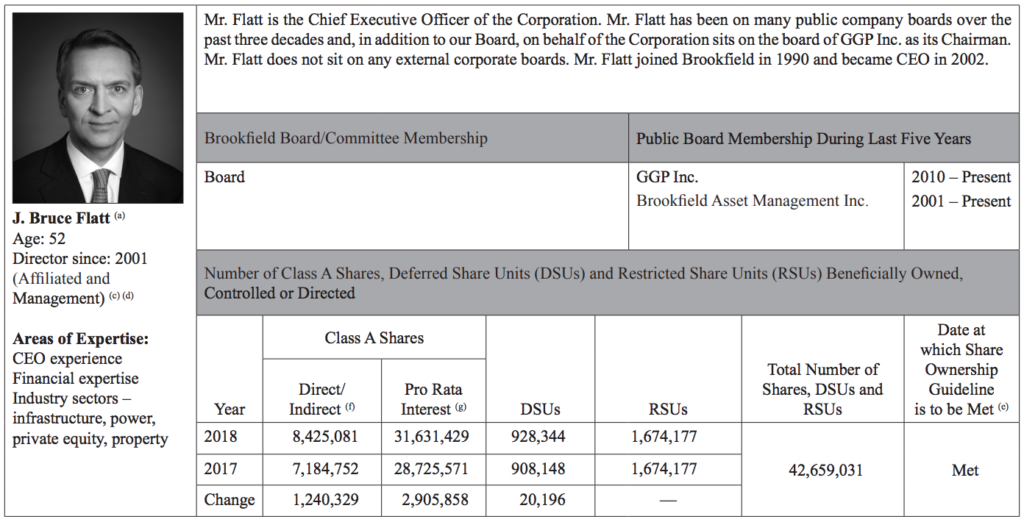

Brookfield is also known to have a highly aligned management team. Its managers and Board of Directors directly own a tremendous amount of stock. As the following image shows, Brookfield's CEO Bruce Flatt owns 42,659,031 shares of stock which is worth approximately US$2.0 billion at the current stock price. As the company's stock performs, so too does Flatt's net worth.

Source: Brookfield Asset Management 2018 Management Information Circular, page 14

If you take a closer look at the image above, you will notice that there is a stark difference between Mr. Flatt's "Direct/Indirect" interest and his "Pro Rata Interest". Why is this?

Footnote (g) states the following:

"The figures in this column include (i) the director’s pro rata interests in Class A Shares held by Partners Limited and PVI (on a consolidated basis) and (ii) the director’s interest in Escrowed Shares (as defined on page 51 of this Circular), which also represent an indirect pro rata interest in Class A Shares. The value of these indirect pro rata interests is impacted by a number of factors including the terms of their ownership, the capital structure of each company, the value of the Class A Shares held by each company and their net liabilities and preferred share obligations (see “Principal Holders of Voting Shares” on page 4 of this Circular for further information on Partners Limited and PVI and “The Escrowed Stock Plan” on page 63 of this Circular for further information on Escrowed Shares). Partners Limited also owns 85,120 Class B Shares, but any indirect pro rata interest in those shares has been disregarded as de minimis."

Brookfield Asset Management 2018 Management Information Circular, page 16

(Emphasis my own)

The key sentence in that passage is the first one. Curious BAM investors have noticed that Brookfield's management team has created a number of private or quasi-public vehicles to allow its managers to retain operational control of the company via owning a large block of this stock.

I was recently made aware via Twitter (read the thread here) that one of these entities (the PVI referenced in the quote above) is actually public and can be owned by normal investors like you and I. This article serves to share my due diligence and final decision on this interesting investment opportunity.

What is PVI?

PVI stands for Partners Value Investments LP, which trades on the TSX Venture Exchange under the ticker PVF.UN. Here is the corporate overview from the company's website:

Partners Value Investments LP is an investment partnership whose principal investment is a 9% equity ownership interest in Brookfield Asset Management Inc. (NYSE:BAM), a global asset manager focused on Real Assets. We also have a growing portfolio of other investments in a variety of companies and industries around the world. Our goal is to invest on a value basis in companies that can demonstrate an ability to produce consistent and durable cash flows and profits, in markets that are growing.

The partnership has an Equity Limited Partnership base of US$2.9 billion (with an additional US$500 million in Preferred Limited Partnership Units post reorganization) and our partnership units are listed on the Toronto Stock Exchange (Venture) under the symbol PVF.UN. We also have three subsidiaries: Partners Value Split Corp., Global Champions Split Corp., and Global Resource Champions Split Corp, held through our 100% equity ownership in Partners Value Investment Inc. All three subsidiaries have publicly-listed preferred shares outstanding and are trading on the Toronto Stock Exchange.

Source: Partners Value Investments LP website homepage

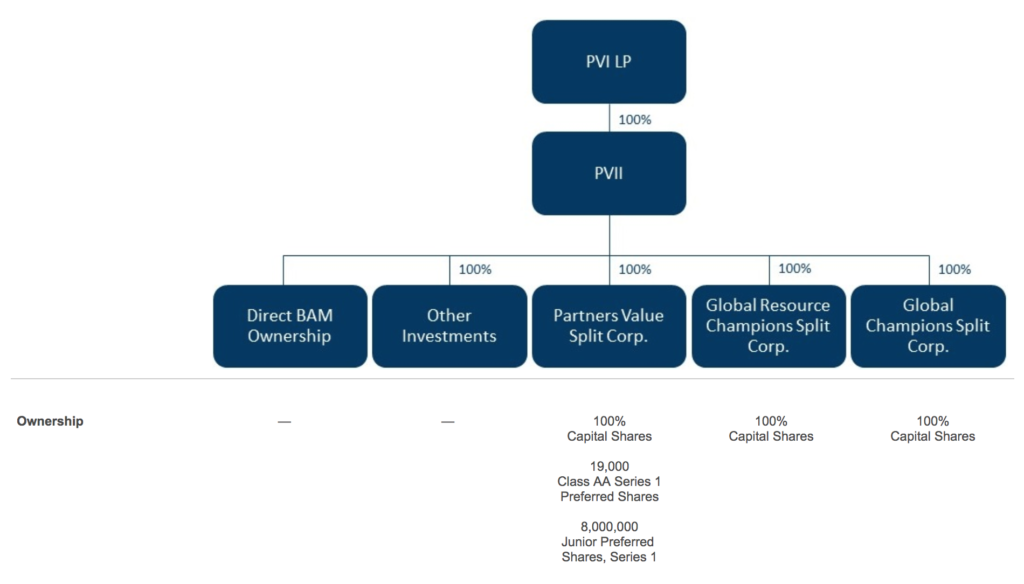

I have always found that organizational charts applied to corporate ownership are useful for understanding complex holding company structures. Fortunately, PVI provides one on their website:

Source: Partners Value Investments LP website

In my view, the prime purpose for the existence of PVI is to gain leveraged exposure to the performance of Brookfield Asset Management. I am not alone in this view. Other investors on Twitter echoed this sentiment, and PVI's management wrote the following interesting passage in its 2018 Annual Report:

The Partnership’s assets are financed in part with the retractable preferred shares issued by our subsidiaries. This results in financial leverage that will increase the sensitivity of the value of the common shares to changes in the values of the assets owned by the Partnership. A decrease in the value of the Partnership’s investments may have a material adverse effect on the Partnership’s business and financial conditions.

Source: Partners Value Investments LP 2018 Annual Report, page 7

(Emphasis my own)

Looking back even further, the management team has previously been even more blunt. PVI's previously Chief Executive Officer, George Myhal, wrote the following in the opening statement of PVI's 2014 Annual Report:

To date, our business objective has been to provide our common shareholders with a leveraged investment in Brookfield.

Source: Partners Value Investments LP 2014 Annual Report, page

With that in mind, the remainder of this article seeks to answer the following question: "If I am bullish on the long-term potential of Brookfield Asset Management, is it better to buy BAM directly or buy PVI.UN instead?"

Valuation Analysis

Since the value of PVI comes entirely from its portfolio of marketable securities, valuing this entity should be relatively easy. All that needs to be done is to compare the per-share value of its investment portfolio to the company's current price on the TSX Venture Exchange.

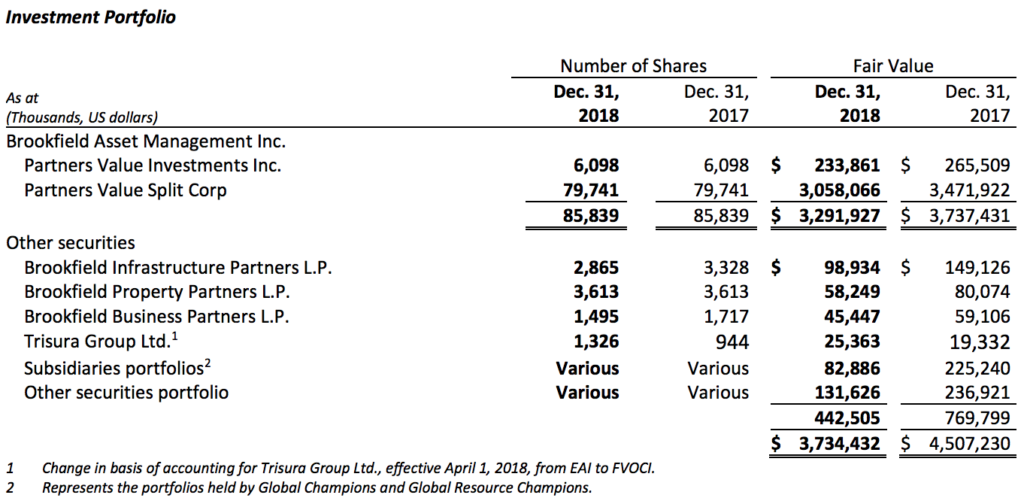

PVI's investment portfolio as of the most recent reporting period (December 31st, 2018) is shown below:

For the sake of conservatism, I'm going to make the following assumptions about PVI's investments:

- The value of its non-Brookfield securities is 0 (this applies to "Trisura Group Ltd.", "Subsidiaries Portfolios", and "Other Securities Portfolio").

- The company is not going to change its ownership stake in BAM meaningfully over time. Looking back historically, this seems reasonable as its ownership stake has been very stable over time if you adjust for Brookfield's various stock splits.

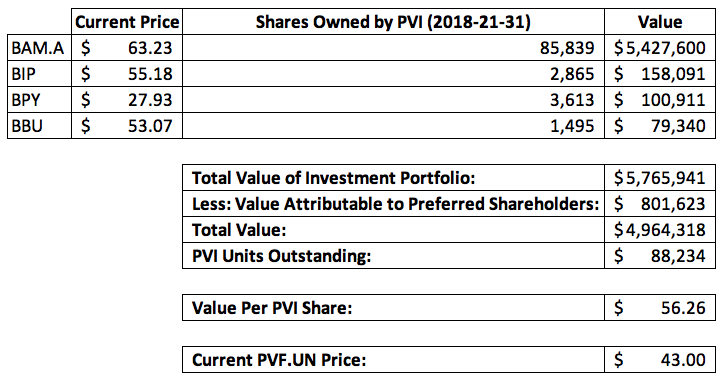

Lastly, since PVI.UN trades on the TSX Venture exchange in Canadian dollars, this valuation work will be done in Canadian dollars as well.

With all that in mind, here's how PVI's current stock price compares to the value of its underlying securities:

Note that this valuation analysis excludes a pretty sizeable US$395 million deferred tax liability. I am excluding it because it's likely entirely from the appreciation of Brookfield shares over time, and the company is unlikely to sell those shares (and incur the corresponding tax liability) since its sole purpose is to own BAM stock. Others may disagree with this but it is an assumption I am comfortable with.

Also note that I used an exchange rate of 1.33 to convert its $602,724 of preferred stock to Canadian dollars to match the currency used in the rest of the analysis.

Final Thoughts

Using conservative assumptions, Partners Value Investments (PVF.UN) seems to be worth at least $56 and it is trading at just $43 today. I'm going to place a buy order for a small amount of this security and potential increase it to a larger position over time.